Cars with wireless charging to transform global EVs market growth

Electric vehicles (EVs) have gained enormous attention in the last decades due to their environmentally friendly features. However, the charging infrastructure has not kept pace to complement the growing demand, leaving ample room for companies to explore cars with wireless charging options.

Businesses are actively transitioning to adopt EVs, presenting compelling reasons for an immediate switch. The urgency is crucial with the 2030-35 deadline for the sale of new traditional vehicles.

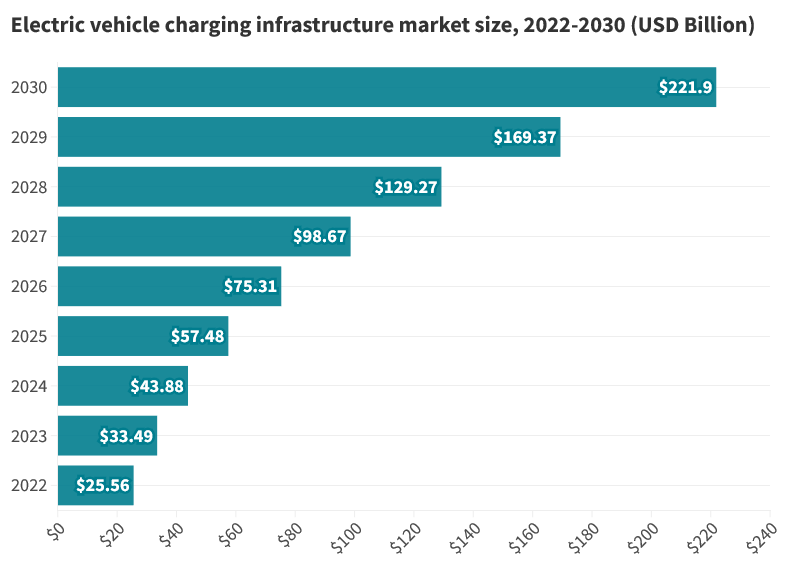

As the demand for EVs increases, expected to reach approximately 350 million by 2030, the global market for charging infrastructure is also projected reach approximately USD 221.9 billion in the same year (Figure 1)— led by China.

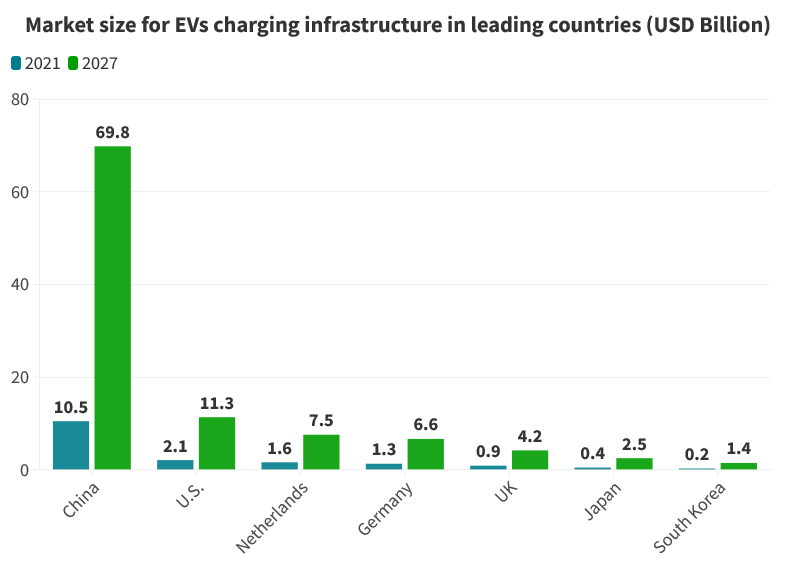

China's EVs charging market soared to USD 10.5 billion in 2021, expected to hit USD 69.8 billion by 2027 (Figure 2). Following China is the U.S. with a market size of 2.1 billion in 2021 and going up to USD 11.3 billion by 2027.

European countries are equally competitive. The Netherlands' market, valued at USD 1.6 billion in 2021, is projected to reach USD 7.5 billion by 2027. Germany follows closely with a projection to reach USD 6.6 billion by 2027.

However, many EVs have a limited range, requiring efficient charging solutions beyond conventional facilities. Recognizing this, EVs manufacturers have shown great interest, particularly in enhancing wireless charging capabilities.

Stations that support cars with wireless charging

Wireless charging for EVs fundamentally eliminates the necessity for physical cables and plugs during the charging process. Instead, it relies on electromagnetic fields to facilitate energy transfer between a ground-based charging pad and a corresponding receiver positioned beneath the vehicle. The charging process is initiated by parking the vehicle over the charging pad, and energy is transferred wirelessly.

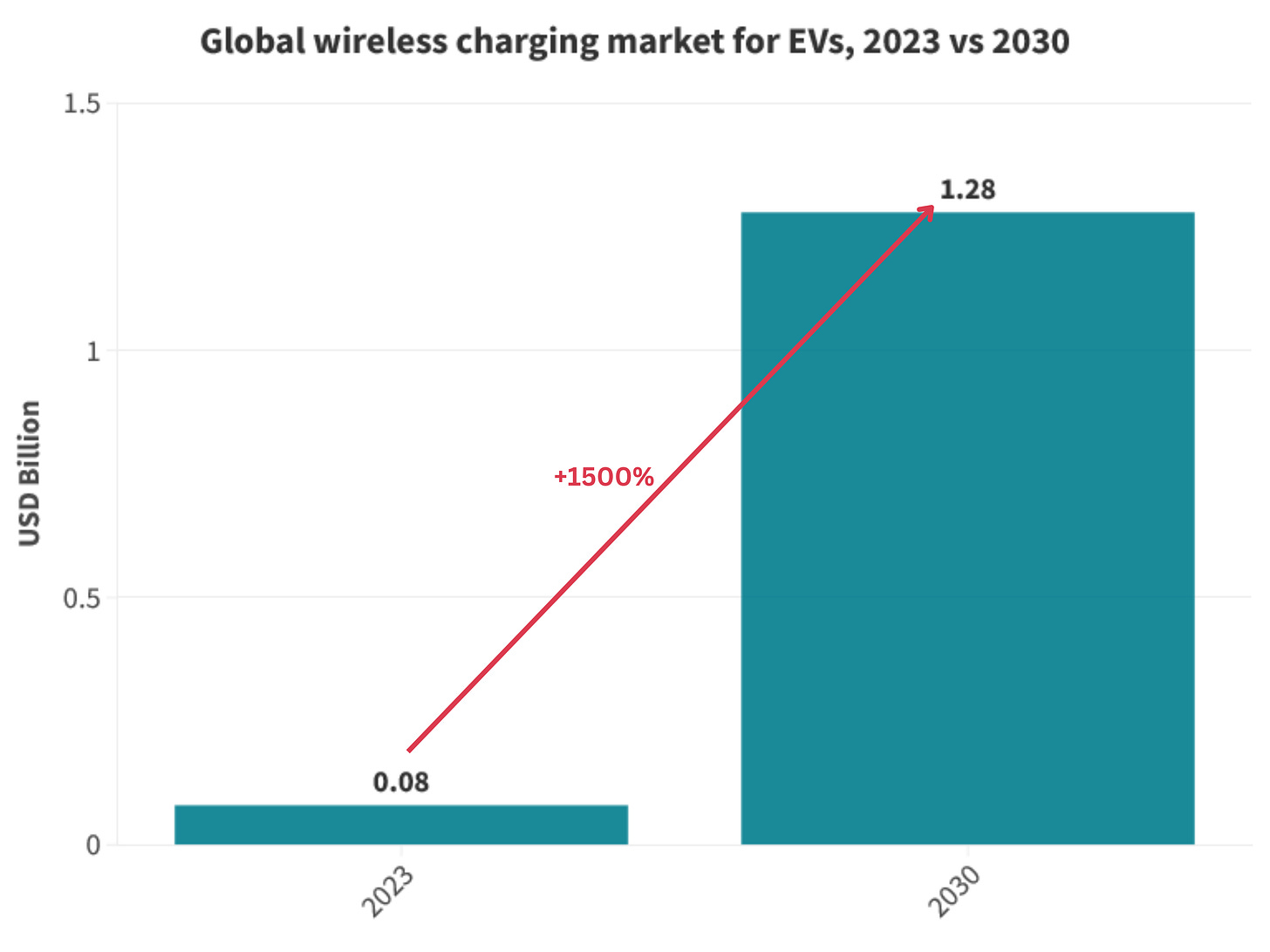

The global market for wireless charging EVs is expected to surge from USD 0.08 billion in 2023 to USD 1.28 billion by 2030 (Figure 3). This remarkable CAGR of 48.4% is due to the increasing focus on e-mobility and growing demand for wireless EVs charging solutions.

McKinsey held a discussion about the perspectives of wireless charging with Gregor Eckhard, COO of automated conductive charging system provider Easelink, chief commercial officer and former chief innovation officer of InductEV, Bob Kacergis and Andrew Daga, and Alex Gruzen, CEO of inductive wireless charging company WiTricity.

''As we navigate the early stages of adoption, wireless charging will debut in premium vehicles due to volume, scale, and cost considerations. Yet, it's anticipated to swiftly integrate into mainstream vehicles'' said Gruzen.

The discussion concluded that while wireless charging holds significant value, implementation costs currently exceed those of cable-based solutions. However, industry stakeholders are optimistic about cost reduction through scaled-up production soon.

Related: Navigating challenges of sustainable investment strategies in focus

Key market players for wireless EVs charging

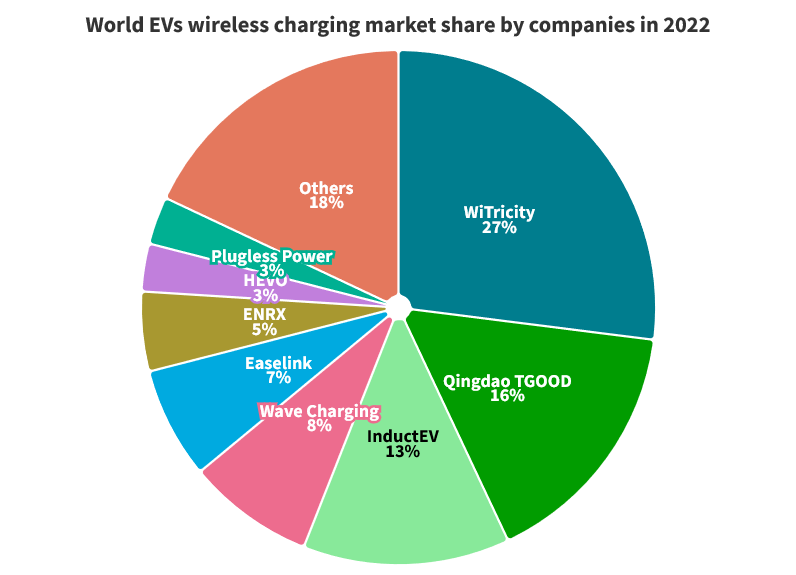

The Next Move Strategy Consulting states that WiTricity holds the largest market share, i.e. a 26% of the total market. QingDao TGOOD secures the second position with a 17% share, while InductEV claims a 13% market share (Figure 4).

These companies have implemented innovative strategies, such as new product development, expansion initiatives and partnerships to establish a strong foothold in the market.

Although the technology still bears some challenges, several reputable vehicle manufacturers have initiated efforts to adopt it. For example, Hyundai's Genesis conducted real-world tests with 23 wireless charging pads in South Korea. On the other hand, Volvo has undertaken a three-year testing phase for a wireless charging system in its XC40 vehicles.

Related: Hybrid vs electric car: how employers can influence the EVs uptake?

What are the current challenges?

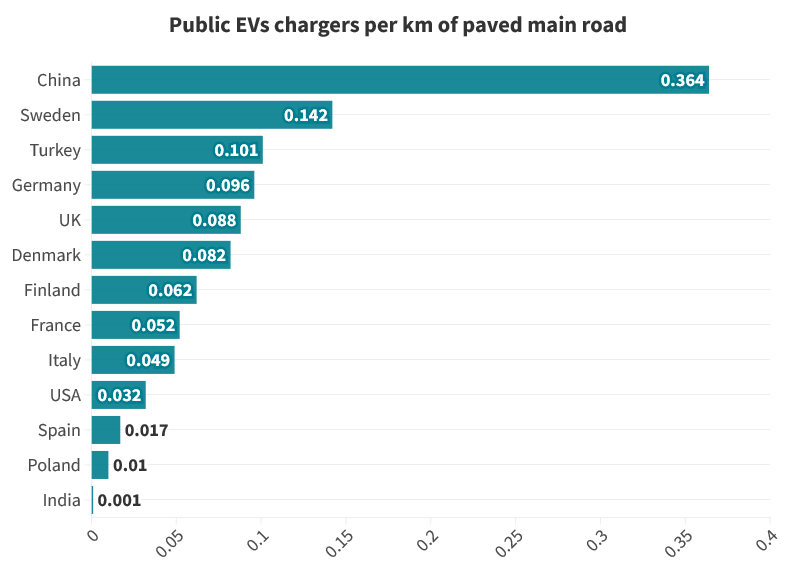

Siemens Financial Services (SFS) has conducted research estimating the current EVs chargers per kilometer (km) of the main road across multiple countries. A notably low number of accessible charging facilities relative to the increasing number of EVs on the roads is a concern, especially in China, which hosted over 50% of the global 26 million electric cars in 2022.

Nevertheless, it stands out for its significant investments in public EVs charging networks. Figure 5 shows that European nations fall short of reaching even half of China's implementation rate. From 2023 to 2025, the global EVs charging infrastructure development is expected to face a €104 billion 'gap' in funding.

This raises the question of whether experimenting with wireless charging facilities is a priority now, instead of rapidly expanding plug-in charging facilities, which is already established technology.

This is the reason why Tesla acquired a German wireless charging company, Wiferion, during the hype of wireless charging but sold it immediately afterward. Tesla essentially assumed that there were other priorities.

Wireless charging cars are an exciting innovation to address the gap between the expanding EVs market and inadequate charging infrastructure. However, it will pose some challenges to accommodate new vehicles equipped with the capabilities. But these challenges could certainly be crucial for understanding its role in the future of electric mobility.

Have some feedback or want to sponsor this newsletter?

Thank you for reading. If you liked this post, please click the ❤️ button. That would improve my visibility. If you love The Green Solutions, would you share your experience with a quick text testimonial by clicking here? Thank you very much.