Navigating challenges of sustainable investment strategies in focus

In 2023, global investors allocated $13.9 billion to businesses engaged in activities like battery recycling and water-efficient crop development. Regardless of the field, companies with comprehensive sustainable investment strategies have advantages in the long run.

The global sustainable finance market was valued at approximately USD 519.88 billion in 2022, with an expected compound annual growth rate (CAGR) of 22.6% from 2023 to 2030.

This incredible expansion is attributed to the increased awareness and concerns regarding climate change and resource depletion. Consequently, businesses face increased responsibility to invest in sustainable solutions, aligning with the values of customers, investors, and partners.

In 2023, FTSE Russell surveyed global asset owners to gather insights into their perspectives regarding various sustainable investment matters. There were a total of 350 participants, collectively managing assets ranging from $7.9 trillion to $14.2 trillion.

The asset owners believe that governance holds a high and similar percentage of priority in all regions and will remain a focal point in the future (Figure 1). Despite short-term fluctuations in sentiment toward sustainable investment, survey participants express a lasting dedication to this evolving theme.

Related: Renewable energy investments call for stronger commitment to net-zero initiatives

Key insights on climate priorities and sustainable investment strategies

According to Deloitte's 2023 CxO (C-suite) Report, leaders consider climate change as one of the key priorities for their organizations. In a conducted survey covering over 2,000 C-suite leaders across 24 countries, a significant number of them ranked climate change within their top three issues (Figure 2).

Economic outlook was the only aspect that received a slightly higher ranking. The report also highlighted that 75% of them have increased in sustainability investments over the past year. According to Deloitte’s Global Climate Check 21, two primary forces are steering organizations towards sustainability initiatives: (i) shareholder pressure and (ii) a surge in societal and employee activism.

Moreover, activism, driven by individuals advocating for change, and sustained media coverage ensure that the matter remains top of mind for business leaders and policymakers. They play a crucial role in bridging the gap between ambition and impact, facilitating a low-carbon economy.

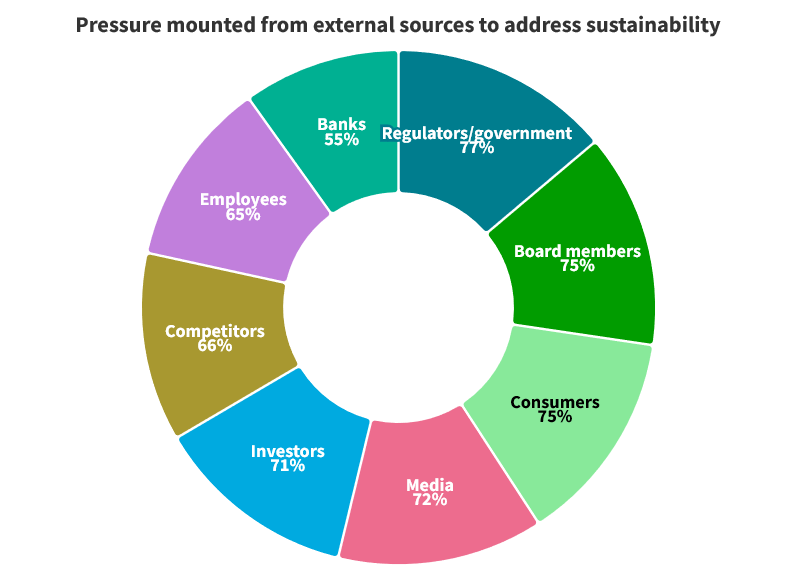

Businesses face substantial pressure from various stakeholders, including regulators, customers, and employees, to address climate change, as demonstrated in Figure 3. Regulatory is a prominent concern, with the government being the primary influencer. Interestingly, a quarter of respondents reported minimal pressure from their board members or management.

Efforts in climate action face challenges

Another survey however presents unsatisfactory outcomes. Eden McCallum conducted a survey in 2023, which resulted in 40% of business leaders expressing being 'very concerned' about sustainability, as opposed to 55% in 2021 (Figure 4).

Recent geopolitical events like war, inflation, and energy crisis may have redirected their focus, contributing to this shift. The survey covered 250 business leaders, predominantly from the UK and the Netherlands.

Giuseppe Bivona, a partner and co-chief investment officer at Bluebell Activist is urging oil and gas companies, such as BP to reconsider their approach. He doubts the likelihood of success in companies' strategy to transition to clean energy from fossil fuels.

"To achieve net zero by 2050, we need societal commitment to the goal and the companies need realistic strategies aligned with the actual possibilities", says Bivona to CNBC.

Similarly, another survey conducted by Gartner gathered insights from over 400 senior business leaders regarding their top 10 priorities for 2022-23 (Figure 5). Environmental concerns surfaced in the ninth position, with 9% of respondents identifying it as a top-three priority. While the number may seem small, it ranked 13th in priority in 2020, indicating a notable increase in interest.

It is clear from these surveys that C-suite leaders acknowledge the need for sustainability in their businesses. However, when it comes to taking action, it doesn't rank among their top three priorities.

Related: Is investing in carbon credits a viable solution to meet climate targets?

How can companies convey their sustainability investment strategies?

The first step is always for the leaders to acknowledge market dynamics and outline the company's responsive actions. However, as the business landscape swifts and introduces uncertainties, companies need to communicate ESG effectively by taking the following approach.

Market research. It requires talking to customers and forecasting the percentage of business sales over the next decades, and their impacts. Key decisions must be made, such as whether the company will commit to electric vehicles or switch to renewable energy by making investments or exploring joint ventures.

Plan the company's strategic approach. Openly communicate to the staff and customers about the strategic approach. For example, the car companies can specify the intention and the pace of transition to go fully to electric. In some cases where solutions are not definite, companies need to focus on research and development efforts, emphasizing the exploration of new materials for less carbon-intensive options.

Clean up the supply chain. In the cases where companies have exposure to huge and complicated supply chains, initiatives lie in identifying suitable suppliers or collaborating with joint ventures for specific objectives.

Contribute to value creation. Leaders must establish a direct and credible link between a company's ESG strategy and its overall value-creation strategy. They should be capable of guiding investors through the reasoning behind their chosen initiatives and should articulate how their strategy will sustain cash flows, mitigate risks, and impact top-line growth.

Related: Innovative strategies for businesses to attain Net Zero ready status

Related: Hybrid vs electric car: how employers can influence the EVs uptake?

The expectations from customers, investors, regulators, and employees are compelling business leaders to intensify efforts in environmental sustainability. However, the road to a sustainable future is a gradual process that demands investment driven by creative strategies. Only after prioritizing sustainability, can the leaders enhance their business development and increase investments to pave the way forward.

Have some feedback or want to sponsor this newsletter?

Thank you for reading. If you liked this post, please click the ❤️ button. That would improve my visibility. If you love The Green Solutions, would you share your experience with a quick text testimonial by clicking here? Thank you very much.